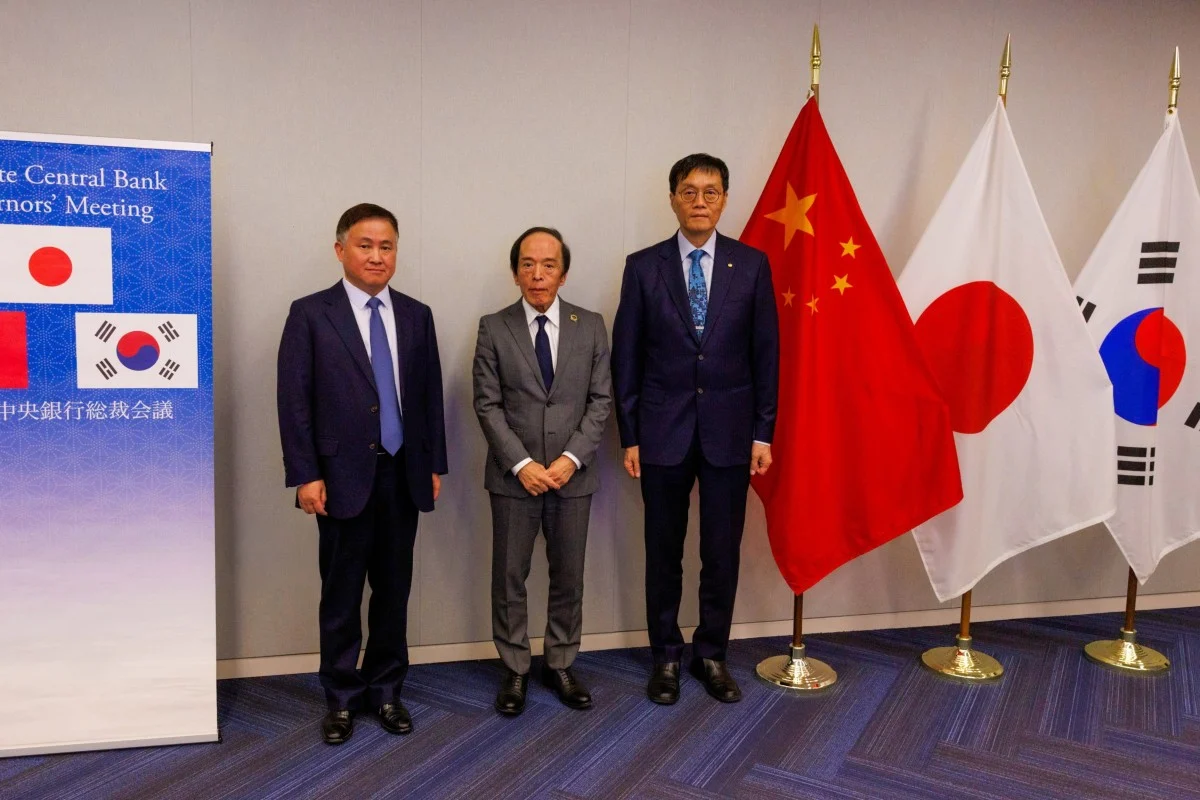

China is engaging in talks with Japan and South Korea. Both, over a potential trilateral currency swap agreement aimed at strengthening the region’s financial safety net and fostering deeper economic cooperation. According to a source familiar with the matter, Pan Gongsheng, governor of the People’s Bank of China (PBOC), discussed the initiative with his counterparts Rhee Chang-yong of South Korea and Kazuo Ueda of Japan during the IMF-World Bank annual meetings in Washington last week.

Currency swaps are financial tools that enable central banks to exchange currencies, offering liquidity support during times of market stress. This proposed agreement reflects China’s long-term goal to increase the global use of the yuan. Aiming to reduce dependence on the U.S. dollar, and strengthen trade ties among the three East Asian economies. Together, these economies represent a quarter of global GDP.

Expanding Regional Cooperation and Financial Sustainability

The discussions come at a time when U.S. tariffs and trade policies continue to strain East Asian economies. While the structure of a possible trilateral deal remains uncertain, some experts suggest it could connect to the Chiang Mai Initiative. This is a broader multilateral currency swap framework established in 2000 among Asian nations to prevent financial crises. Future discussions are expected to continue during the ASEAN and APEC summits.

Currently, China maintains a five-year, 400 billion yuan swap agreement with South Korea, that expires soon, and a three-year, 200 billion yuan deal with Japan signed in October 2024. Meanwhile, South Korea and Japan renewed their own bilateral swap worth US$10 billion in December 2023. These agreements highlight growing regional efforts to enhance financial resilience amid global uncertainty.

China’s Expanding Global Currency Network

China has been actively building a global network of currency swap lines, now totaling 4.5 trillion yuan across 32 central banks. This includes partnerships with the European Central Bank and Iceland. PBOC officials have emphasized that this network has become a key component of the global financial safety net.

Looking ahead, Beijing plans to expand the scope of its swap agreements, particularly with economies that maintain strong trade and investment ties with China. This strategy aims to increase liquidity, stabilize markets, and facilitate international trade, reinforcing China’s growing influence in global financial governance.

Reference

Tang, F. (2025, October 21). China eyes 3-way currency swap with Japan and South Korea amid Trump’s tariff war: source. South China Morning Post. https://www.scmp.com/news/china/money-wealth/article/3329849/china-eyes-3-way-currency-swap-japan-and-south-korea-amid-trumps-tariff-war-source?module=top_story&pgtype=homepage