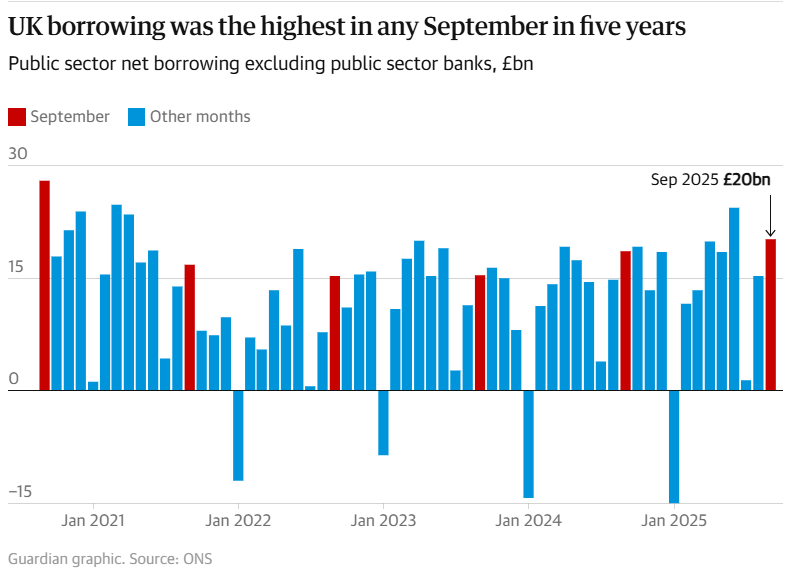

The UK government’s borrowing surged to a five-year high in September, reaching £20.2 billion. This has been driven by rising debt interest payments and higher welfare spending amid persistent inflation. According to data from the Office for National Statistics (ONS), this marks the highest September borrowing since 2020. As increased tax revenues failed to offset growing financial pressures., the government opted for this plan.

From April to September, total borrowing climbed to £99.8 billion, about £7.2 billion above the Office for Budget Responsibility’s (OBR) forecast. Despite a £4.2 billion downward revision from earlier months, the current budget deficit reached £71.8 billion, exceeding projections by £13 billion.

While employer national insurance contributions rose due to policy changes, overall government spending increased by over £10 billion. There has been a £3.8 billion rise in debt interest payments. The OBR expects borrowing to decline in the second half of the fiscal year due to higher capital gains tax revenues and lower debt interest payments. But analysts warn that fiscal conditions remain tight.

Economists such as Martin Beck (WPI Strategy) and Nabil Taleb (PwC UK) highlighted that Chancellor Rachel Reeves faces a “difficult balancing act” ahead. Resulting in a limited fiscal flexibility and mounting pressure to raise taxes. The deficit could reach nearly 5% of GDP, an unusually high figure for an economy operating close to full employment.

Meanwhile, consumer spending has stagnated as households brace for potential tax hikes. Reflecting broader concerns about economic stability and the government’s ability to manage public finances amid weak growth and rising costs.

Reference

Inman, P. (2025, October 22). UK borrowing reaches five-year high for September at £20.2bn. The Guardian. https://www.theguardian.com/business/2025/oct/21/uk-borrowing-high-september-debt-public-finances-rachel-reeves