Secretary of State Marco Rubio and President Trump on Saturday after an incursion that resulted in the capture of Venezuelan leader Nicolás Maduro

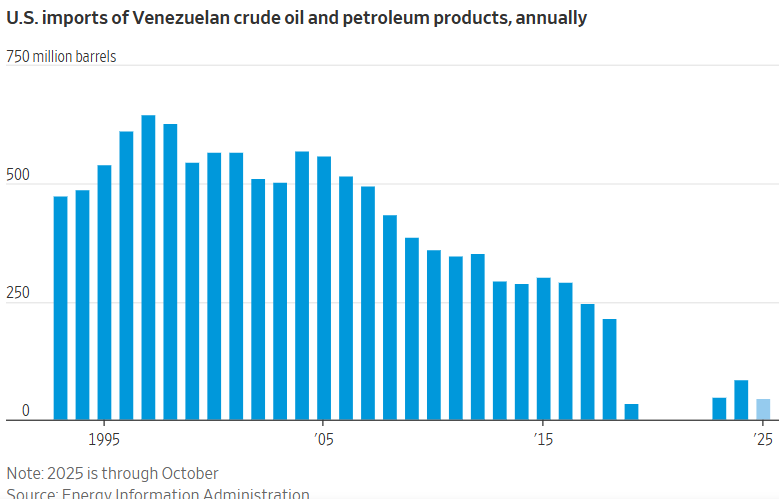

President Trump signaled impending disruption in Venezuela weeks before U.S. forces captured Nicolás Maduro, hinting to American oil executives that dramatic changes were ahead. Oil lies at the center of Trump’s high-stakes strategy. He envisions U.S. energy companies pouring billions into Venezuela to revive its crumbling oil infrastructure and unlock what could be the world’s largest reserves. The administration argues that boosting production would stabilize Venezuela’s economy, curb migration to the United States, and help keep global energy prices in check.

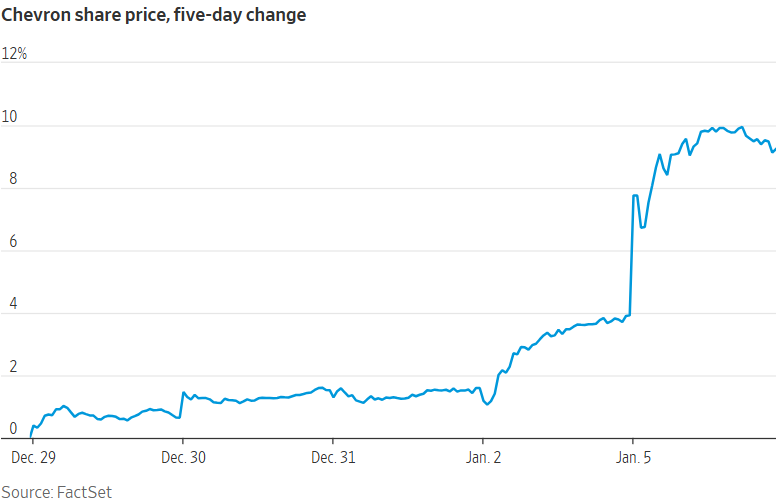

Despite market enthusiasm and rising share prices for major oil firms, industry response has remained cautious. Chevron, the only major U.S. company still operating in Venezuela, has no immediate plans to expand investment. Citing its concerns over political stability, legal protections, employee safety, and the ability to repatriate profits. Other giants such as Exxon Mobil and ConocoPhillips have shown little interest in returning after past nationalizations, underscoring the uncertainty surrounding Trump’s plan.

The White House has begun outreach to energy companies, with senior officials leading the effort. Yet, analysts warn that without firm commitments from the oil industry, the administration’s vision for reshaping Venezuela’s economy and governance could falter. Even if companies eventually invest, restoring Venezuela’s oil output would take years, leaving Trump’s bold gamble dependent on corporate confidence in a volatile and unresolved political landscape.

Reference

Eaton, C., & Leary, A. (2026, January 5). Trump’s hint to oil executives weeks before Maduro ouster: ‘Get ready.’ The Wall Street Journal. https://www.wsj.com/business/energy-oil/venezuela-chevron-trump-strikes-maduro-195eb6e3?st=YrbLvK