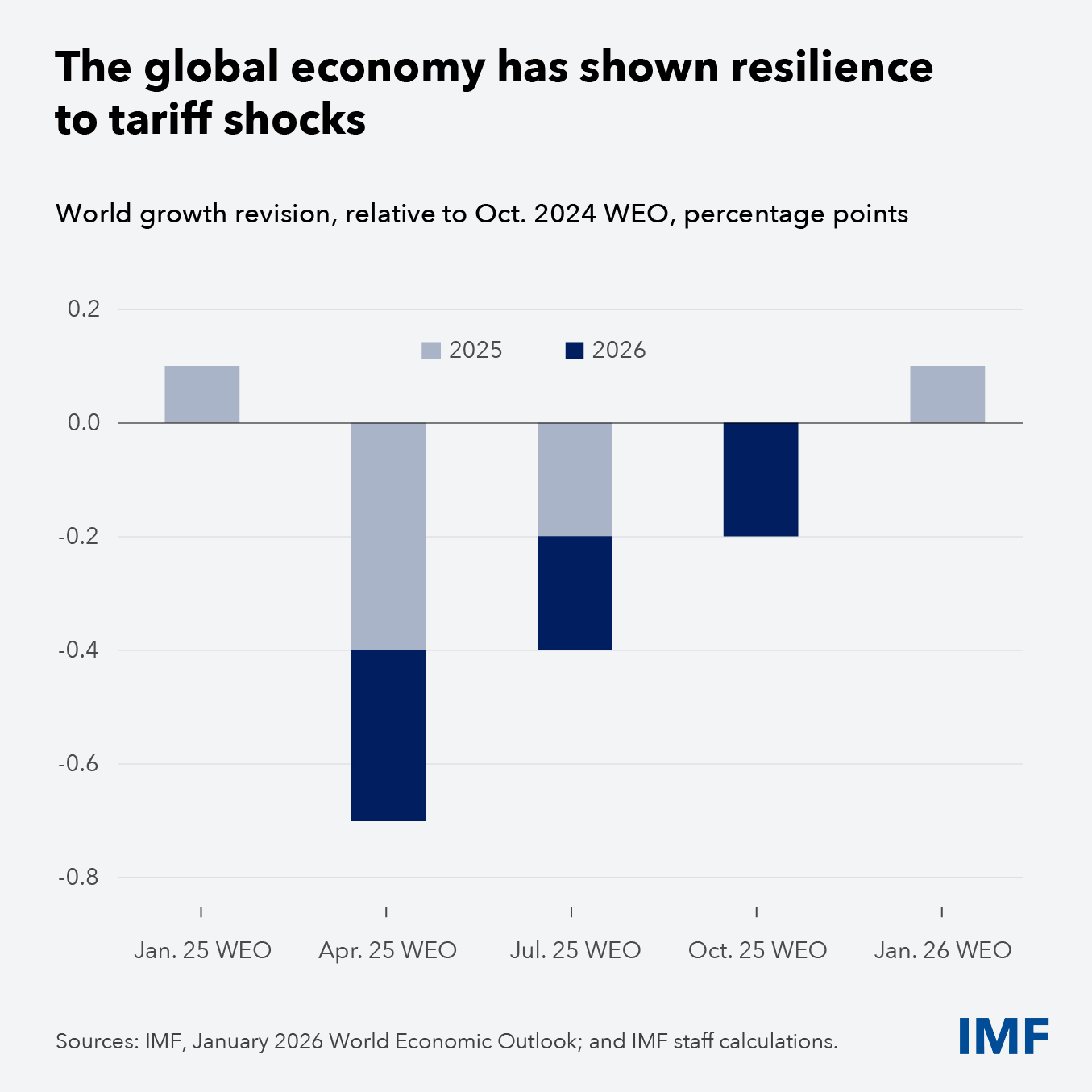

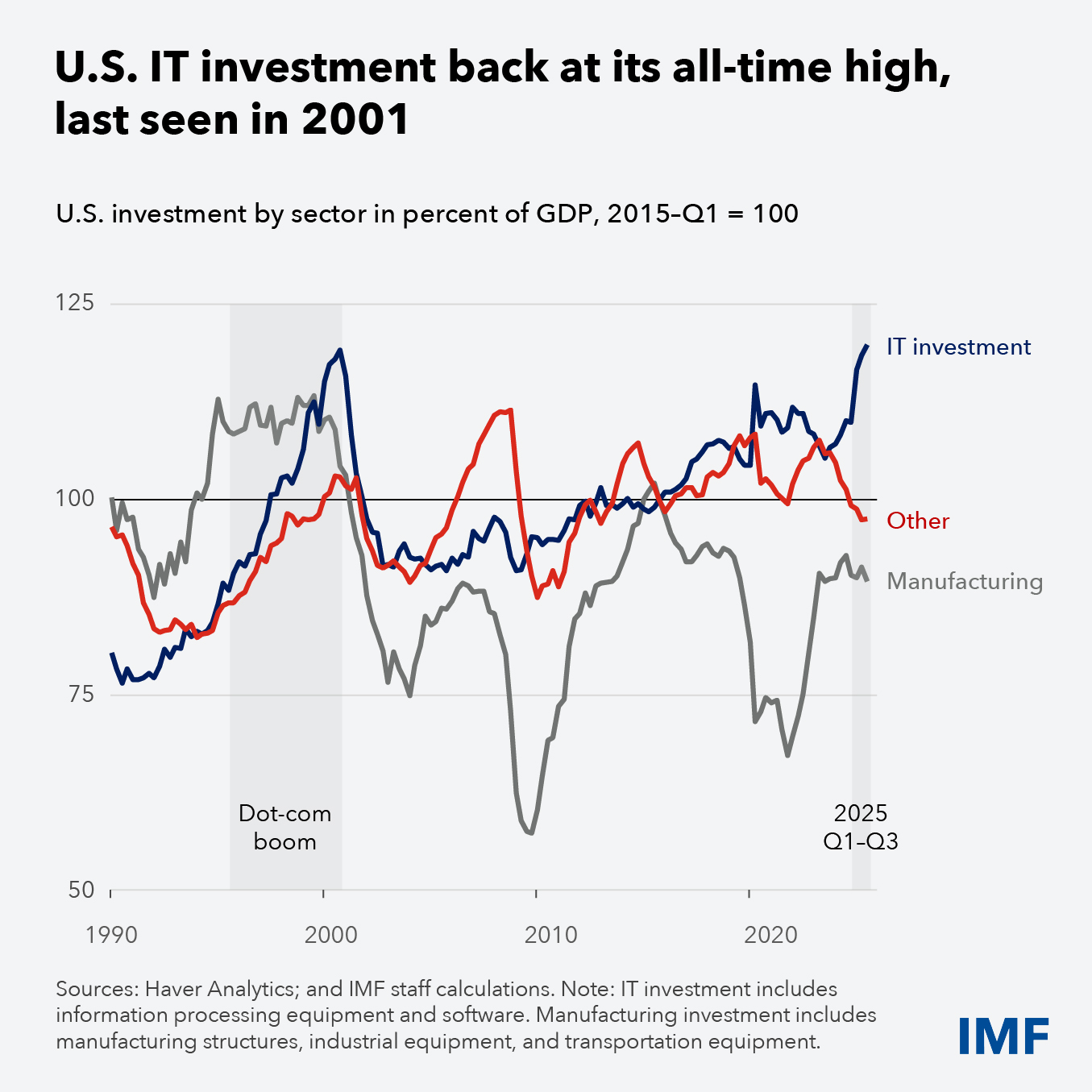

Global economic growth is holding up better than expected despite trade disruptions led by the United States and elevated uncertainty. Growth is projected at 3.3% this year, unchanged from a year ago and slightly higher than earlier estimates. A consequence of the strong performance of the US and China. The global economy has absorbed the initial tariff shock thanks to easing trade tensions, fiscal support, accommodative financial conditions, adaptive private sectors, and stronger policy frameworks in many emerging markets. A major pillar of this resilience is the surge in information technology investment—particularly in artificial intelligence. This has offset weak manufacturing and generated positive spillovers, especially for Asian tech exporters.

Financial conditions fuel expansion

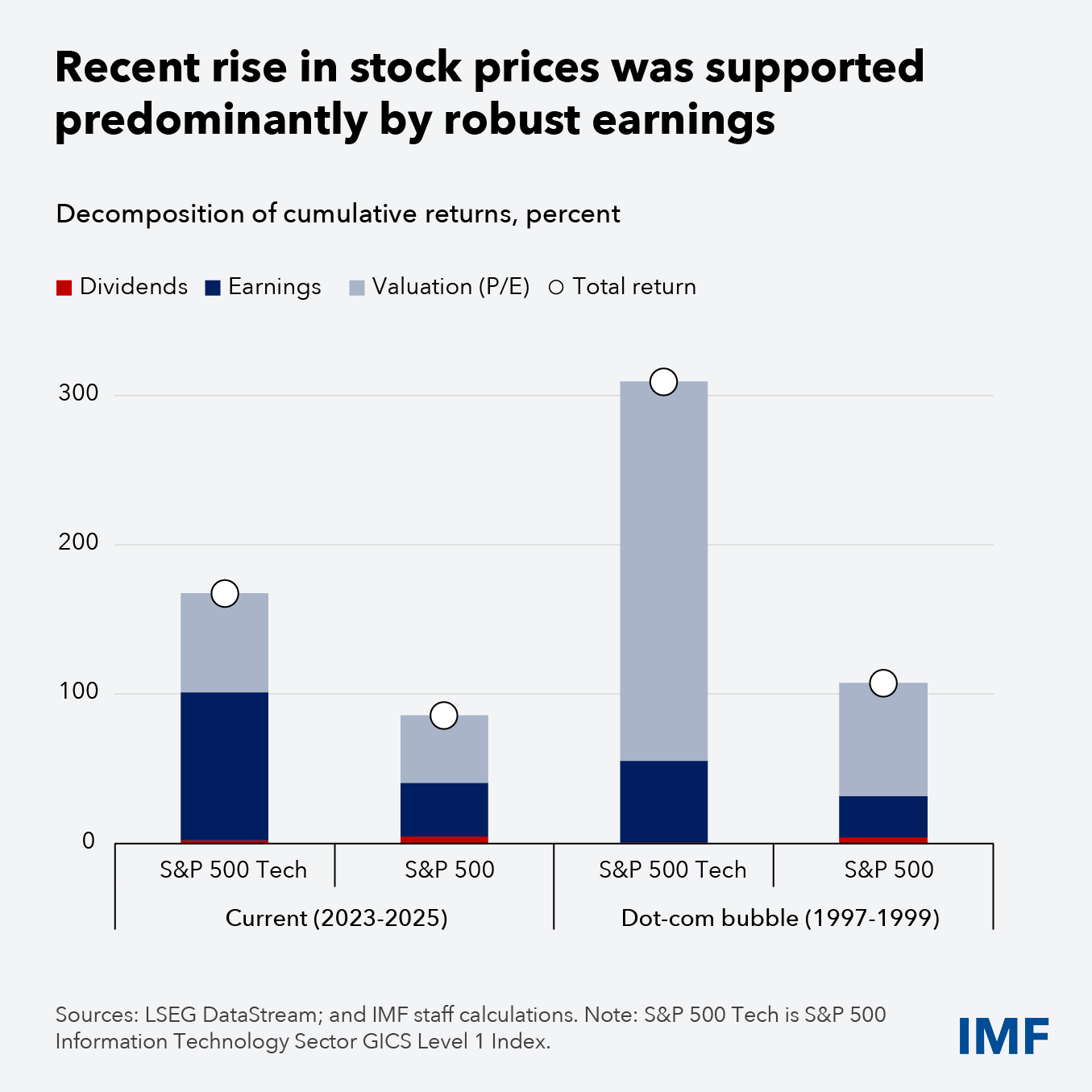

The boom in IT and AI investment reflects strong confidence in productivity gains and profit growth from new technologies. Since the emergence of widely used generative AI tools in late 2022, equity markets have risen sharply. Favorable financial conditions and solid earnings have supported both rising stock prices and capital spending. However, the expansion increasingly relies on debt financing, raising leverage and financial risks. If returns disappoint or financial conditions tighten, high leverage could amplify shocks. Profitability also depends on rapid equipment depreciation and frequent upgrades, which could compress margins and increase borrowing needs.

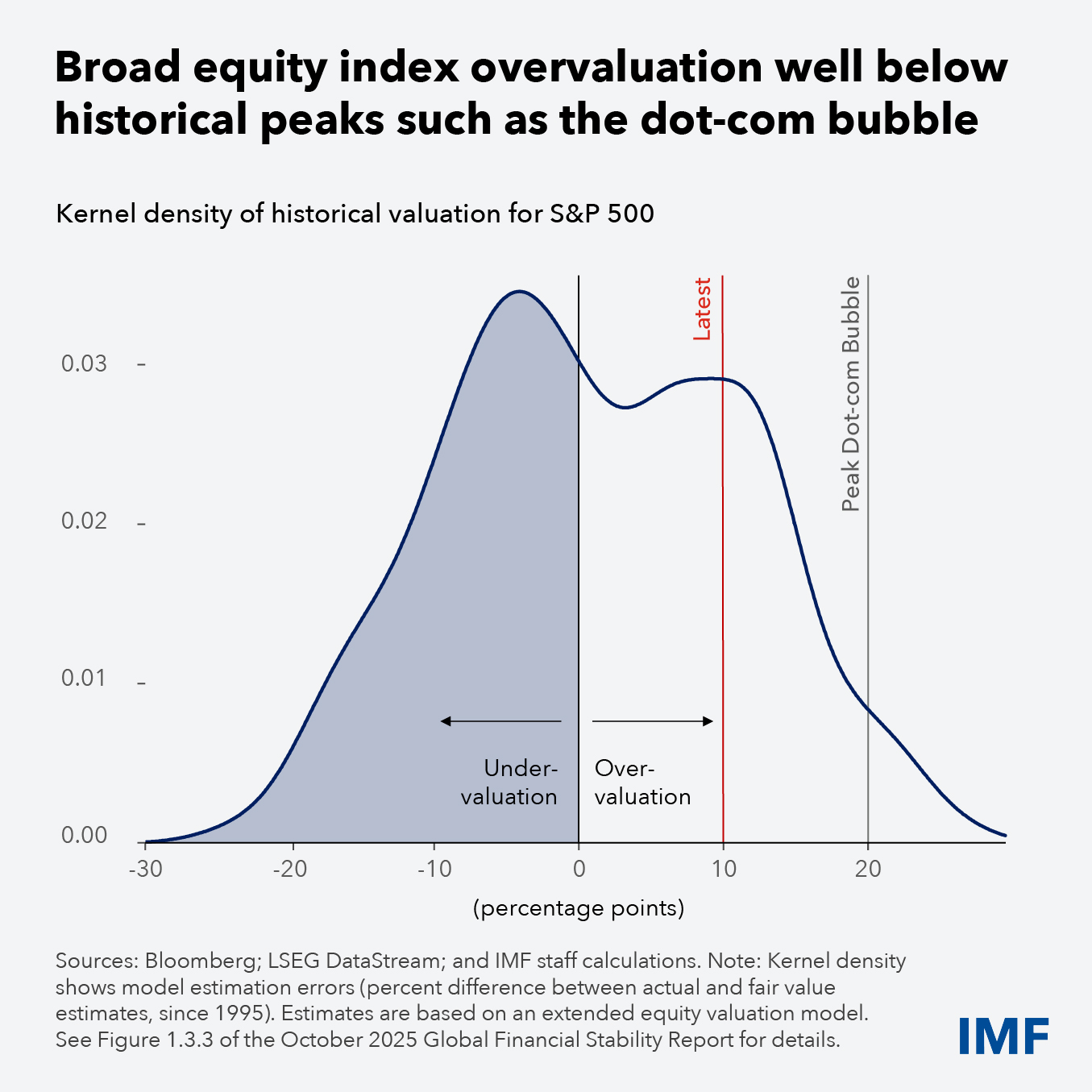

Lessons from the dot-com era

Comparisons with the dot-com boom highlight both similarities and differences. While IT investment as a share of GDP resembles late-1990s levels, the current rise has been more gradual and valuations rest on stronger earnings. Potential overvaluation in US equities appears significantly lower than during the dot-com era. Still, vulnerabilities remain substantial. Technology and AI-related stocks dominate market gains, many key AI firms rely on debt rather than equity markets, and overall market capitalization relative to output is far higher than two decades ago. Even a modest correction could therefore have outsized effects on consumption and growth.

Risk to the outlook

The AI-driven expansion presents both upside and downside risks. On the positive side, productivity gains from AI could lift global growth by about 0.3% this year. On the downside, disappointing earnings or a shift in investor sentiment could trigger a correction in tech valuations. This scenario would tighten financial conditions and cut global growth by as much as 0.4% below baseline. A sharper downturn could spill across borders through wealth losses, reduced consumption, weaker trade, and higher borrowing costs. Affecting even countries with limited exposure to the tech sector.

Policy for stability, discipline, inclusion

Heightened valuations, rising leverage, and geopolitical uncertainty call for strong financial oversight. Regulators should enforce robust standards, especially for institutions exposed to the tech sector, and maintain internationally agreed capital and liquidity rules. Monetary policy must balance risks carefully: a sustained tech boom may require tighter policy, while a downturn would demand swift easing. Central bank independence remains critical for credibility and stability. On the fiscal side, governments should rebuild buffers and reduce debt where possible. Policymakers must also address AI’s uneven labor-market effects through skills development, job mobility support, and competitive market frameworks to ensure broadly shared gains.

Balancing Act

Global growth remains resilient, but underlying vulnerabilities persist, particularly from concentrated investment in the tech sector and accumulating trade-related frictions. AI offers transformative potential, yet it also brings financial and structural risks. Sustaining growth will depend on balancing optimism with prudence. This involves strengthening institutions, and ensuring that technological progress translates into stable and inclusive economic outcomes rather than another boom-and-bust cycle.

Reference

Adrian, T., & Gourinchas, P. O. (2026, January 19). Global Economy Shakes Off Tariff Shock Amid Tech-Driven Boom. IMF Blog. https://www.imf.org/en/blogs/articles/2026/01/19/global-economy-shakes-off-tariff-shock-amid-tech-driven-boom