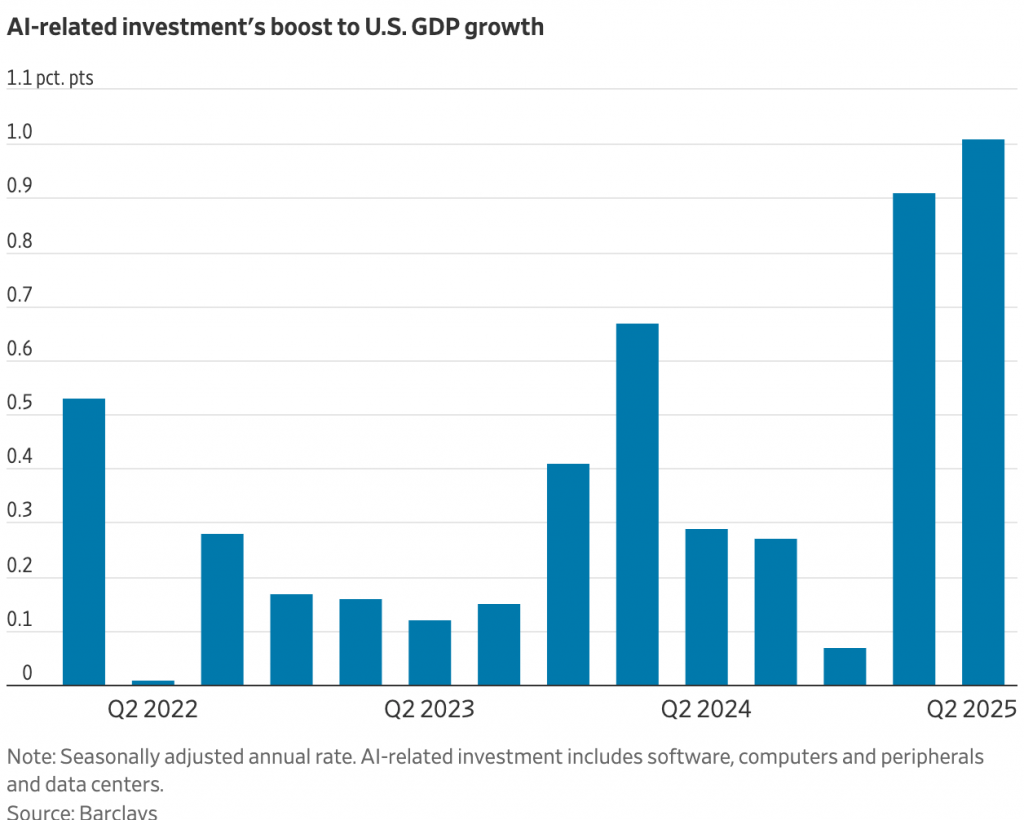

Economic growth in the U.S. has become increasingly tied to the rapid expansion of artificial intelligence. Recent volatility in AI-related stocks exposed how heavily the broader economy now depends on AI investment and the wealth generated by booming tech valuations. Analysts estimate that AI-driven business spending contributed roughly half of all inflation-adjusted GDP growth during the first half of the year. Without that support, overall growth would have been sluggish, as job creation has slowed, unemployment has edged higher, and private investment outside of AI categories has remained flat since 2019.

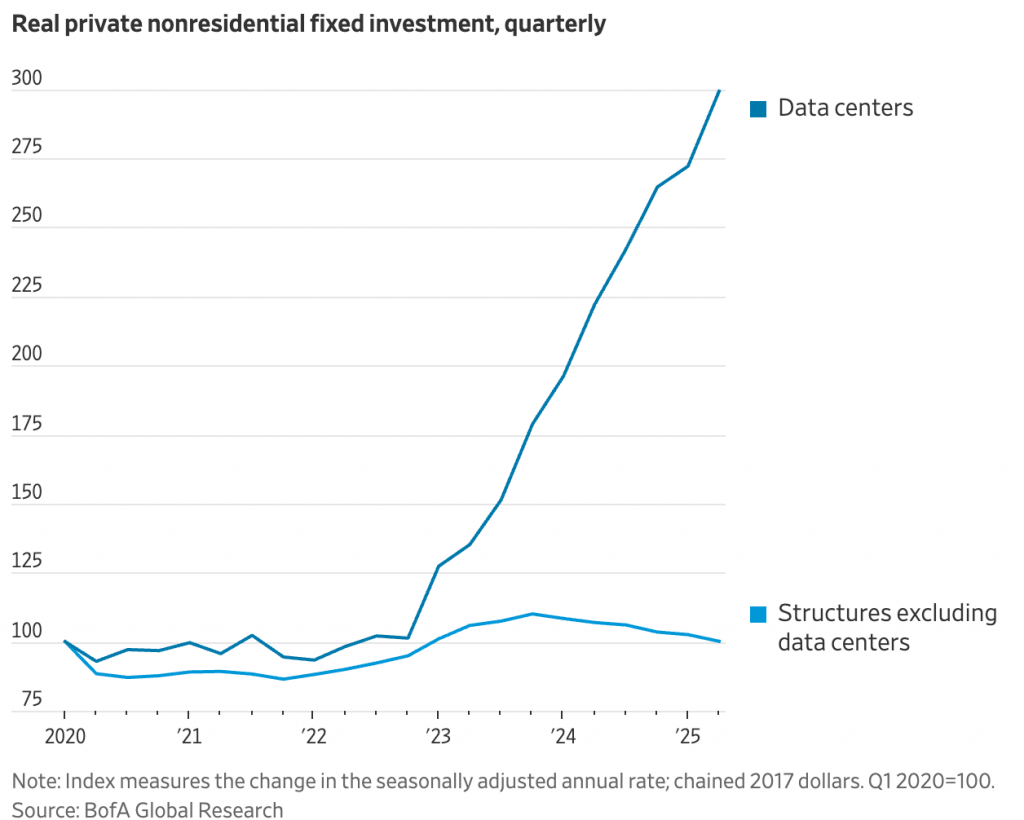

A handful of tech giants, Microsoft, Amazon, Alphabet, and Meta, are propelling most of this expansion through unprecedented capital expenditures on data centers, chips, and computing infrastructure. These companies are expected to spend more than $340 billion this year and over $400 billion next year, reinforcing AI as one of the few major sources of investment in an otherwise cooling economy. Rising AI stock prices have also fueled household spending. Wealth gains from AI-linked equities have added an estimated $180 billion in consumption over the past year, contributing to overall economic momentum even as productivity gains from AI remain limited.

The problems

However, this growing reliance introduces significant vulnerabilities. Valuations for AI stocks are near historic highs, leaving the economy exposed to a sharp correction. A 20% to 30% market decline could reduce GDP growth by up to 1.5 percentage points. Meanwhile any slowdown in AI capital investment could subtract another 0.5 to 1 point. The construction boom in data centers has created jobs, but labor and materials shortages suggest strain across the supply chain. Rising corporate debt tied to AI expansion such as Oracle’s $100 billion debt load and heavy borrowing by data-center leasing firms adds another layer of risk. If expected revenues fail to materialize, stress could spill into broader credit markets.

The overall picture is one of remarkable growth powered by AI, but also of mounting exposure. A downturn in AI spending or a collapse in tech valuations could amplify existing fragilities in the labor market, investment landscape, and financial system—raising the possibility of a recession if the boom falters.

Reference

Putzier, K. (2025, November 24). How the U.S. Economy Became Hooked on AI Spending. The Wall Street Journal. https://www.wsj.com/tech/ai/how-the-u-s-economy-became-hooked-on-ai-spending-4b6bc7ff?st=fFiGvN